Importing a classic car can be a complicated affair and depends on both your own circumstances and also that of the car. It’s also different when importing from within and outside of the EU.

The rules have changed since the UK left the European Union on the 1st January 2021 – we have updated this article with the information we know at this time. Please remember we are not an official source of information, we’re petrolheads trying to help our community navigate through this process.

You must satisfy yourself that you have done all your own research and accessed official sources in your own country for further information.

View all of Trade Classics Articles here!

There really is a lot of conflicting and confusing advice on forums / other sites. So in order to make sure I give you accurate advice I’ve done a lot of research and even called HRMC to confirm the somewhat confusing Import Duty and VAT position.

So I thought I’d write this article about the process for importing a classic car from the EU (European Union or Community), e.g. Italy, France, Germany and Spain, and also highlight the differences from outside of the EU; like USA and Australia. I’ve also written a generic blog on the UK registration side of importing a classic car, i.e. what to do once your lovely classic car hits UK soil – click here.

For the moment, I am going to assume that you are a private individual car owner who wants to import a classic car for non-business reasons and not for re-sale. Here are a few actions / considerations you’ll need to think about before embarking on bringing your dream car or motorbike back into the UK.

1.0 Research Classic Car Prices

2.0 Classic Car International Transportation

How are you going to get the car back, i.e. drive it back or arrange a transporter, or if you”re shipping your car from America then what carrier are you going to use. From the EU and as a very rough guide, a multi-car transporter will cost between £800 to £1000 per car from somewhere like Swizerland, Austria or Italy. This is going to be the most expensive part of bringing a car back into the UK – here are a couple of people you can call to work out a price:

Overland Transportation from EU Countries to UK:

http://www.carseurope.net

http://www.move-a-car.com

http://www.kentvale.co.uk

Shipping from USA to UK:

http://www.shipmycar.co.uk

http://www.penbrokecartainer.com

3.0 Importing a Classic Car from the EU to the UK, e.g. from Italy, France, Spain or Germany

Update March 2021 – the following information is out of date, i.e. they were the rules for importing prior to the UK leaving the EU. We will publish the new rules once they have been officially confirmed. It is likely the rules mentioned in Section 4.0 below will apply.

It”s a much simpler process to import a car from mainland Europe, e.g. Italy, Spain, France or Germany.

A representative from HRMC told me that “Single Market Rules” apply and it’s not a strict “import” as we are all considered one under EU law, so is more a “movement” of goods. So this is good news for the majority of us as:

a) No import Duty is liable – as it”s a movement of goods around the EU.

b) Also no VAT is liable – this is because VAT would have been paid in the country of origin on its original purchase.

The process steps to follow are:

a) Purchase of the car in the EU country of origin:

Make sure the car has a local MOT, e.g. a “revisione” for an Italian car (important if you plan of driving it back).

Make sure you insure the car – especially if you plan on driving it back home. You will need to use the car”s VIN number as you won”t have the new registration number until later in the process. Most classic insurance companies accept this identification and will issue a certificate.

In some EU countries you need to apply for temporary plates, e.g. in Italy the number plate is assigned to the driver and not the car – this is an additional cost and can set you back about 400EUR for signing the property document and 175EUR for the temporary plates. If the seller trusts you then you could use their plates to drive it home (if they don”t need them) and you could send them back in the post when you get to the UK.

Collect the original copy of the temporary registration document.

Collect the official declaration of sale with the sale price signed by you and the seller and a Notary.

Obtain a Certificate of Ownership.

b) Drive or Transport the Vehicle back to the UK.

c) Notify HRMC and organise the car’s MOT.

d) Register the vehicle with the DVLA – see my other article on this process – click here

Also, there are a couple of ancillary fees to add, namely a Customs Fee of about £50 and a DVLA registration fee of £55.

4.0 Importing a Classic Car to the UK, e.g. from the USA, Africa, India or Australia

Logistically this is more complicated and also more expensive as it also involves the near certain liability of Import Duty and VAT. Classic cars coming in to the UK will be subject to Customs Duty and VAT, as they are considered to be “new goods to the UK”.

I really recommend you contact an experienced importing company to help you with this process, however, the following will outline the steps you need to consider and will give you more knowledge on the subject.

a) Purchase the car in the country of origin – make sure you obtain key documentation, e.g. sale agreement, registration documentation.

b) Ship the vehicle back to the UK via a trusted shipping company.

c) Complete a C384 form to work out the amount of Customs Duty and VAT liable (for Private Motor Vehicle) for import purposes. You can download the C384 form via Her Majesty Revenue and Customs website = click here

d) Notify HRMC and organise the car”s MOT.

e) Register the vehicle with the DVLA – see my other article on this process – click here

4.1 Importing Cars Over 30 Years Old – 5% VAT Liability

Importing cars that are over 30 years old reduces VAT liability by 15%, as just 5% is charged against the cost of the car. This could mean a significant amount of money difference on ‘modern classics’ e.g. if you purchase a 1986 Ferrari 328 GTS for $100k then you will save circa $15k on the cost of import. So when you’re looking at potential cars then be careful as just a one day difference in the registration date could be a significant extra cost.

UK customs have their own exchange rate for calculating VAT and Duty and it’s updated on a monthly basis – use this to work out the latest exchange rate – click here.

VAT is calculated as: $ Invoice + $ Shipping / Customs Exchange Rate + £Duty (if any) * 5% = £VAT

Note: yes Duty is added to this calculation as it is also subject to VAT too.

4.2 Importing Cars Under 30 Years Old – 20% VAT Liability.

As mentioned above – 20% VAT is charged and you’ll need to pay this when the car arrives into the UK.

UK customs have their own exchange rate for calculating VAT and Duty and it’s updated on a monthly basis – use this to work out the latest exchange rate – click here.

VAT is calculated as: $ Invoice + $ Shipping / Customs Exchange Rate + £Duty (if any) * 20% = £VAT

Note: Duty is added to this calculation as it is also subject to VAT too.

4.3 Importing Cars Originally Made in the EU – Any Age – £50 Duty Liability

If the car you’re purchasing was originally made in the EU then this will reduce your total Duty liability from 10% to just £50 admin fee. Again a significant saving if you’re planning to import cars from manufacturers such as Porsche, BMW, Mercedes and Jaguar.

4.4 Importing Cars NOT Made in the EU – Under 50 Years Old – 10% Duty Liability

So if you’re looking at a non-EU manufactured car such as Ford, Chrysler, Toyota and Cadillac then your total Duty liability will be the full 10%.

Duty is calculated as: $ Invoice Cost + $ Shipping Cost / Customs Exchange Rate * 10% = £ Duty.

Here”s a link to a handy online calculator to help you work out the costs – click here.

4.5 Shipping and Transportation Costs for Importing a Classic Car

This is one of the larger expenses – you can generally count on circa $1000 for shipping costs from a USA to a UK port (Tilbury / Southampton / Felixstowe) for a shared container (two cars in one container). RORO (Roll On Roll Off) is cheaper but I wouldn’t recommend for a high value classic car. Also, remember you’ll need to get the car to a US port and that could increase the costs significantly. For example, it may cost circa $300 to securely transport a car a hundred miles or so to the nearest US port, but what if your car is in Texas and has 1,000 miles to get to a nearest port; well that could be another $1000 on top.

4.6 Classic Car Shipping Insurance

So your car has cost a few dollars and you want to make sure you don’t lose out if the worst happens like the ship goes down, or the car suffers damage in transit. Well you’ll need to think about insurance and that will roughly cost you 2% of the total cost of the car. So that Ferrari 328 GTS you’re thinking about for £100k will cost you $2,000 in insurance. Of course you could cut corners and leave this out – if you dare!

4.7 UK and USA Port Fees for Importing a Classic Car

USA port fees will be just over $200 and UK fees at £175 at the time of updating this blog (March 2017). So quite reasonable but make sure you include it as it all adds up.

4.8 Modifying the Car for UK Roads

Don’t forget you’ll need to get the headlights amended for UK roads and get the car MOT’d – depending on the exotic nature of the car this could cost you a few hundred pounds. I’d personally recommend you put £1000 by for this work and any other unexpected bills / parts you may need.

4.9 DVLA Registration Fee and MOT

You will need to get the car MOT’d first after the legal modifications to lights have been made – this will cost you circa £50 depending on your chosen MOT station. Once that is done you can then apply to the DVLA for registration to get the V5 logbook – this will cost you £55.

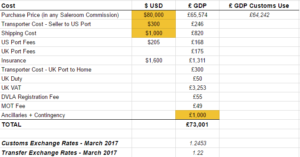

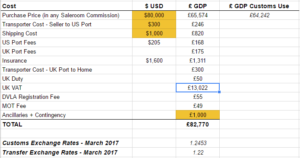

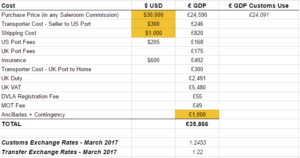

5.0 Example Costs for Importing a Classic Car from the USA

6.0 Important Notes

– EU and Non-EU Manufactured Cars – If you are planning on importing an originally EU manufactured car to the UK from outside of the EU, e.g. you import a Porsche 911 from California, then the Customs Duty is waived (just £50 admin fee). However, UK customs will need to see evidence that the car was originally exported from the EU. In order to prove this, you can provide a copy export entry, the export invoice or the export bill of lading/airway bill. If none of these documents are available, you could also try to get hold of an official letter from the manufacturer which confirms that the car was fully manufactured in the EU. Please bear in mind that this needs to be ‘official’ and therefore needs to be on company-headed paper, and signed. If you can’t provide one of these pieces of evidence, then unfortunately you will have to pay import Duty and VAT, as if the car was newly entering the EU. UK customs will not except that a car has to be EU made just because the manufacturer is European!

– Importing Cars Over 50 Years Old – If the car is over 50 years old, coming into the UK from outside of the EU, then you don”t pay any import Duty and pay VAT at a reduced rate of just 5% as it”s classed as ‘historical interest’ under the 9705 ‘Goods of Historical Interest’ clause.

– Importing Cars Over 30 Years Old – If the car is over 30 years and under 50, coming into the UK from outside of the EU, then it may be also be officially classed as ‘historical interest”, under special circumstances and like cars over 50 years old means that you don’t need to pay import Duty, and that you pay a reduced rate of VAT at only 5%. However, in order to qualify for this, you will need to complete the ‘Binding Tariff Information’, this is basically a request for reduced import tax which you need to obtain from HM Revenue and Customs. For example, it may be very rare, have been used for a particular purpose, or owned by a famous person etc. If you think that this may be the case, then you can write to customs and ask to be considered under the 9705. However, I can reliably tell you the chances of obtaining this cause is very slim based on peoples” past experiences written up online. My advice: don”t waste your time unless the car was owned by Elvis and pay the normal Duty / VAT.

That’s it, a lot to take in and different rules based on where the car is being imported from, but hopefully will give you the necessary steps to follow to make sure there are no nasty surprises.

Please remember, once you have your car through customs process, you then need to contact the DVLA in order to understand the registration process for your imported classic car. Please read my article ’How do I register an imported classic car in the UK‘ for more information on the process.

Emma

EMMA JONES

This article was written and published by Emma Jones. Emma works for Trade Classics as an in-house journalist and copywriter and has many years’ experience in the classic car sector. Why not write a reply on this article below – she’d love to hear your thoughts on her thoughts!Also, don’t forget to check out the classic cars for sale here on Trade Classics.Google+

Tags: customs duty, importing classic cars, registration, uk c384 form, VAT

Categories: Classic Car Blog, Government Policy

So basically my 1972 fiat 500 Abarth that I purchased from Italy but is in Spain with me now will cost me nothing when I ship it back to the UK by car transporter, is this correct.

Thanks

Lance

In the article above under 4.0 you say that by downloading form C384 you can work out the duty payable, but form C384 only lets you apply to pay the duty, it is worked out by HMRC and I can see no guidance on what it might or might not be. So how can we know in advance if duty will be due before we commit to buying a car?

Hi Emma,

I’m thinking of buying a classic car from Southern Ireland and importing into UK. What duties would I be liable for, the car is 41 years old..??

Many thanks

Alan

Hi Emma, i am looking at importing a Classic Truck from Southern Ireland back to the UK. The truck was originally registered in the UK in 1977, then exported to Malta in the late 1980’s, then exported to Southern Ireland around 2005. Can you please tell me what the VAT / Import implications are please. Cheers Dez

Hi

Very informing article

I need some information about dealing with cars imported from the USA to resell either in the UK or other European countries.

Thank you

HI Emma, if i import motorbikes that are all over 30 years old under a EIRO/VAT number, i will pay 5% vat which I can reclaim. If i them sell them, do we have to add 5% vat, no vat or 20% vat?

Hi Emma, very helpful, but I’m not entirely clear about the VAT on 50+ year old car. I am looking at a 1951 MG in the USA. It was originally built in the UK and exported to the US. If I imported it, would the VAT be 5% or would it just be the £50 duty liability?

Are Motorcycles which are over 30 years old and imported from Japan Duty exempt and only 5% VAT?, if yes are they sold in UK at the same rate?

Great article and super helpful – thanks!

We would like import Classic car from Germany to UK ( Mercedes 190SL 1959/ Registered in Germany 1962) can you please let us know the formalities and duty/tax calculations.

Hi Emma, your publication on importing vehicles to the UK is well written and I acknowledge your time and effort in preparing same. I live in Ireland and am considering advertising my EU manufactured 36 year old classic motorcycle for sale in the UK. Therefore I would like to learn how much VAT and duty a UK buyer would be liable for now that the UK is outside the EU.

Assume the sale value of the motorcycle is €20,000 and the shipping cost is €500 and using current customs exchange rate.

I look forward to your reply.

Sincerely yours

Gene Hourihan

Hello everyone – so post Brexit it’s a bit tricky to find out the current rules for moving cars between UK and EU, i.e. the VAT / Duty due. We assume it’s international rules but we are trying to validate this for you. We’re trying to speak to people in HMRC to find out but it’s proving tricky to a. get hold of them and b. get hold of someone that really knows. Lydia from our team is trying her best and spent many hours on hold to them now. But sit tight as she’ll hopefully have the answers in the next week or so.

Adam – Trade Classics.

P.S remember we have other blogs on this here – these will all get updated when we find out more info:

https://www.tradeclassics.com/how-do-i-import-a-classic-car-into-the-uk/

https://www.tradeclassics.com/how-do-i-import-or-export-a-classic-car-after-brexit/

https://www.tradeclassics.com/shipping-an-imported-classic-car-into-the-uk/

Do I save any purchase tax on the price of a car in the US if I’m exporting it? Do their quoted sales prices already include that tax?

Hi, I am importing a 1964 Unimog vehicle from Zimbabwe via Walvis Bay on RORO ship. What will be the duty on this and will this be eligible foe the 5 % VAT if it is to be used on a farm as an agricultural vehicle ?

Hi

You seem to suggest that ALL cars over 30 years old qualify for 5% vat. Is that the case as I can’t seem to find that info anywhere else. The gov website looks like it’s assessed on an individual basis?? I am importing a 68 Jensen interceptor from Germany does that qualify for 5% and £59 duty?

Hi Does the rate of 5% VAT apply to importing a 30plus year old motorcycle from Italy to UK after Brexit ? Thanks

I’m afraid it’s all a bit up in the air, the Gov website says “needs to be updated post Brexit” and we haven’t managed to get a clear answer from any transport companies either.

Hi Emma thanks for your detailed insight on this topic.

I have 2 questions, firstly if I car is 40+ years old in the UK it doesn’t require an MOT so if I was to bring a car of that age over here from the states would I not have to get an MOT?

Secondly if I was to modify a 40+ year old car by installing a moden engine would that still keep the car as classic status ie no road tax, no MOT?

Hi Emma

I am planning to import a restored VW Caddy from Hungary (EU) with my friend. I am wondering what costs we will have and what procedure I have to get through. The car is from 1984 (1.6 diesel) and it has its papers, at the moment it is registered in Hungary.

It would be great if you can help us with some guidence.

Many thanks

Attila

Hello Emma,please help,how to register citren HY van in uk,i buy this car in uk ,but with france paper,

what to do?thank u

Hi.

In fronce after January 2021 will i need to pay import tax on a second hand car from the uk.

If it’s all ready been paid.

Thanks.

Still TBC, they are trying to make a deal happen as we speak!

Hi Emma

I’m looking at buying a 1969 Vw Karmann Ghia from the USA. The owner doesn’t have a title but would include a bill of sale and previous owners contact details. Would this be allowed to leave the USA ? Enter the UK

Many thanks

Jon

Hi, if you don’t have the title/registration document from the country the car is being imported from, then you’ll definitely have to get a letter from the manufacturer that details where the car was made etc. I’m not sure on the procedure for VW, this is something you’ll need to look up. Best, Kulraj

Hi Emma,

I am looking at buying a 1974 Kawasaki from Italy and bringing it back to the UK? Is there time to get it back here and registered before 1st January (only 4 weeks with Christmas in the middle) and if it can’t be done by then what are the tax implications?

Hi Emma does southen ireland come under eu rules thanks gary

Hi, out of interest is a knock down kit (CKD) constructed vehicle considered built from the country of assembly or country of parts manufacture? Does it depend on other factors such as how many parts were sourced locally? Take VWs, BMWs etc assembled in South Africa for example. Are they of EU origin?

Thanks

Paul

Hi, ‘Under current laws, VAT between EU countries is currently waived’ is quoted in the sister article ‘Under current laws, VAT between EU countries is currently waived’ linked above at the top of this article. I’ve read this article twice and I see no reference to VAT being waived between EU countries. Have I missed something or is this a glaring omission in this article?

Any one can give me advice. Bought a car outside europe. Want to bring it in uk .keep it for 1 month or 2 and sell it to somone who want to ship it to Kazakhstan .how this works . thanky

Emma importing a classic Riley 1953 RMF. Swedish number plate now but still has UK original logbook and numberplate. Can I just drive or tail the car back to UK?

Regards

Igor

Does Sweden come under EEC like Germany, France, Italy etc

Hi Very interesting article. If I want to buy cars from USA and sell in the UK, do I have to register for VAT. Can I claim the VAT and should I charge for VAT when selling the car

Emma.

I have bought at auction a 1973 Cadillac Fleetwood Eldorado Cabriolet from an owner in Spain.

Naturally, I believe this to be a genuine vehicle, and that there is a genuine seller (via Catawiki).

Clearly, I need:-

The Registraiton Document,

Spanish equivalent of an MOT,

Proof that import duty to Spain/EU was paid when it came in.

Emma, what else should I request?

John Wallace

07770 410 010

wallacelondon1@btinternet.com

Excelent article, thaks for sharing!

I have a brother in the USA is it true if he buys and keeps for six months then brings to UK can he sell to me and cut import duties

can a non uk resident import a classis car to the uk

Hello Emma

Thank you for the article which is really well laid out and very helpful.

I want to import an historic vehicle 1965 from South africa back to the UK. The car has been dismantled and so is partly in bits, The engine is in the engine bay but does not work and lots of the other parts are in boxes. The vehicle has been a non runner and off the road for many years. I want to import it and put it back together again. It has no papers. Is there anyway I can export a non running vehicle that has no papers? can it be imported as car parts or something similar? Grateful for any advice that you can offer

Many thanks

Will

I am moving back to the UK from France. I have a 1959 and 1960 Cadillac. Both vehicles are registered in my name here in France. They also have French classic car MOT equivalents. They will arrive in the UK late September/early October. Could you please describe the process I must follow. Many thanks.

Hi Emma,

I would like to import a 40 year old Suzuki motorcycle from South Africa most of the bike is there but stripped down in pieces is this spares, or a complete bike for importation, duty etc?

Regards

Tony,

Thanks for sharing this valuable information!

Hi Emma,

I have a 1987 BMW E28 M5 that I wish to import to the UK . The vehicle was assembled in South Africa from a kit sent from Germany. Would the vehicle qualify for the import duty exemption (i.e. the 50 Pound administration fee)? What rate of VAT would be payable and on what value? The vehicle is registered in the name of a company. All shares are owned by me.

Regards,

Dave

fantastic article

i have two classic Ford Pick up trucks. a 1948 and a 1952 F1. Each are small 1/2 picl ups with V8 engines, original Texas titles and I’ve owned both for greater than 6 months whilst living in the USA. Will these be exempt of duty and VAT (5%) as I’m a UK expat >6month rule? Do Historic / classic pick up get classed as cars or are they classed as commercial vehicles? Thank You

Hi Emma,

I am a New/Used car dealer in UK, i have bought a 1983 2cv in Italy which i was going to drive home next week, can i use my garage plates or do i have to get a Q plate from the DVLA ?

Or is there a simpler way ?

I bought a ’73 DS from France, registration could not have been easier! Provided you have the Italian reg docs then all you should need to do is apply for UK registration with DVLA. In theory they can come and check on the car or ask you to take it to a local DVLA office (are there any now?), but this didn’t happen. As for driving it home – well you’ve probably done it now anyway – just use the Italian plates.

Hi Emma,

I plan to import a Toyota Land Cruiser 1980 petrol engine from outside the EU (Indonesia). I still keep the original document, paperworks, etc, since it was bought by my late father and never been sold nor undergone any substantial change over the last 40 year period. If the parts have to be replaced, then I will choose the Toyota OEM parts. I prefer to keep the car as close to its original condition. Since I relocate to the UK, I decide to ship her over here( personal use ). There is no intention to sell it. I enjoy driving her very much. As well as the British, Indonesian drive on the left hand side, so the vehicle is right hand drive

Please clarify if provide the details correctly:

First of all, from my understanding, since it is more than 10 years old, it does not need any IVA (Individual Vehicle Approval) test. Is this correct?

Secondly, It was first time registered in Jakarta, Indonesia in May 1980. It aged 40 years old in May 2020, therefore it no longer needs annual MOT. However your article states that it must still be roadworthy (I also read this in gov.uk), then the MOT should be conducted (but not compulsory). It would also smooth the registration process. Is this correct?

Third, this vehicle was produced in Japan. For Indonesian market, it has never been originally equipped with rear seatbelts. There is no official reason for this. As long as I know, this was thought to decrease the price so that would encourage Indonesian people to buy (the economy was not too good in that period). Are rear seatbelts compulsory pertaining to this circumstance? It does have front seatbelts only. What should I do if I want to transport children over 3 years but under 135cm without any rear seatbelts?

Fourth, it has never been equipped with rear fog light. Regardless of which market, Toyota Land Cruiser 1980 was never produced with any rear fog lights. Is rear fog light compulsory in this circumstance?

Fifth, the speedometer for Indonesian market uses metric system. So it doesn’t show mile per hour, but kilometre per hour. Odometer also measures in kilometres. Would this be fine? Speedometer is working and well lit at night.

Sixth, this car has turned 40 years old (May 1980-July 2020), must I therefore still pay the VAT and duty?

Seventh, the car is currently taxed under my mother

s name. When my father bought it in 1980, he registered it under my mothers name. It has never been sold to anyone including me. My mother does not feel comfortable with this car due to its originally heavy clutch, then I have been driving it since 2009. I paid the tax under my mothers name. Do I have to do something with this ie register it under my name before shipping it over?Eighth, does DVLA have any issue ie amends the imported cars headlamps? The vehicle is still using its original headlamps. It of course was blown several years ago, but I replaced with its original Toyota headlamps.

I apologise for the long comment.

Regards,

Roan

Hi great article could ask I am interested in a motorcycle that has been brought to this country but has not got a nova document it is over 40 years old and has the German version of a V5 what would be needed to register it thanks.

Hi Richard, I’m not sure if motorcycles fall in to the same rules, I would recommend checking the .gov website for details. Best, Kulraj

I wan to buy a VW beetle cabriolet 1965 from New Zealand. Dealer has said they will pay for shipping. Its over 50 years old. Am i just liable for VAT at 5% of the purchase cost and a £50 admin fee? I need to know if there are hidden issues..! Paul

That sounds about right Paul. Always worth checking the .gov website too.

Great & informative read. Good work!

Fantastic information. I’m looking at bringing in a 1986 Fiat Premier Padmini from India. It wouldn’t be road legal at entry, and I’m not sure what would be required to get it to the DVLA standard. Would I still be able to import it? Any information would be much appreciated.

Hi Niz, your car isn’t quite 40 years old yet, when they hit 40 years it makes it super easy to register. Ensure you have sale agreement documents/the Indian registration documents, and it’s also worth getting a letter/certificate from the manufacturer confirming the car details from the original build.

Hi Kulraj, that’s good information. If over 40 years, what are the DVLA requirements in terms of being road legal? Any info would be much appreciated, thanks again. Niz

Same requirements stand true, but when a car is over 40 years old, registering is very easy as the car falls in to a classification with the DVLA of “Historic” and so just simple information like chassis/engine numbers, colour, engine size are required when filling out the registration forms.

Cars over 40 years old do not need an annual MOT carried out, however, they do need to be able to pass an MOT to be on the road. In a practical sense, if you were pulled over with a classic car that is not road legal, it could be taken away from you. That’s why actually get an annual MOT is often good practice.

That’s great, thank you for the information, I really appreciate your help with this.

Hello Emma, the car I plan to import is in Poland and is a 1965 Lancia Fulvia. A 1965 vehicle is MOT exempt in the UK so is it still necessary to obtain an MOT following import? (granted it is wise to ensure the car is safe to drive). Thanks

Hi Colin, yes is it worth getting an MOT. Even though classic cars over 40 years old do not need an annual MOT, they do need to be road legal. Going through the MOT process will ensure this, and can often help with the registration process of the car with the DVLA (my understanding is an MOT can often reduce the chance they will want to come and inspect the car). Hope that helps, Kulraj

I want to buy 1968 Alfa Romeo which is currently registered on German plates to the UK .The car is being held by a Belgian car dealer and they have agreed to ship it to me to London the only documentation it has is the green 2 part German registration document. Will this be enough to register as a Historic vehicle in the uk

we have 1966 mustang brought from EU country . Want to restore in Asia and want to bring back to UK. can you please explain the procedure?

Hi I am interested in buying back my old 1966 mini. I originally sold it to

A guy in London. It was then sold to someone in France. From there it was sold to someone in Switzerland just 8 months ago. The guy registered it in Switzerland but now has agreed to sell it back to me.

I’ve found someone to transport it back but not sure on any other documentation or taxes etc. The guy still has the French registration documents also. He said he will de register it in Switzerland whatever that means

Hi a friend exported a 1990 Ferrari registered car from UK to HK in 2015. He didn’t change the car to under his name nor registered it in HK. He now wants to return it to the UK. It was a UK registered car. Does he need to pay VAT on it when it returns? If he sells it will he have to pay VAT on it? Is there a time restriction to avoid VAT if sells it? Thanks.

Hi Roger, your friend should have informed DVLA the car was leaving the UK for more than 12 months according to this; https://www.gov.uk/taking-vehicles-out-of-uk. I am not sure when these rules came in though, and how they then might affect the import of the car back in to the UK and any associated taxes etc. Sorry we can’t be more help.

I’m interested in a British motorcycle manufactured in 1929. It was originally sold through a dealer in Denmark. The person selling it is in Belgium, and he bought it off someone in Holland. The bike has probably has been off the road for 40 years, is incomplete and is a restoration project. Is this classified as importing a vehicle, if so how does it fit with the legislation? Thanks

Hi Emma I want to import a 1987 classic car from Spain but the car was originally from the UK is it easier to import the car back to the UK..?

Regards tony

I there Emma Jones!

I need some advise on dealing with a car purchase and registration from outside europe:

What papers do I need to import 1970’s not running (for restoration) BMW car from Caracas (Venezuela) to UK or any other european country so I can pay as little as possible once I have a lot to spend on that restoration.

What are the steps I have to do (transportation, papers, invoices, wich car documents, and then MOT before or after the restoration, etc…), please.

Thanks in advance for your answer.

Stay safe and please accept my best regards,

JP

Is it possible to import a 25 year old car from Northern Cyprus as we don’t officially recognise the country

I’m not too sure on that one to be honest. Normally when you import a car you provide the papers for the country it was registered in. Also a 25 year old car doesn’t fit in to the classic/historic bracket so it’s hard for us to advise. Well worth checking out the .gov website for details.

Any problems with importing an MG from Northern Cyprus as we don’t officially recognise it ?

Hello, I bought a Mexican made 1986 VW bay window combi and its being restored and converted into a camper by a garage in Mexico City. I had planned to travel with it in Mexico and the Americas but travel restrictions during the Covid19 shutdown obviously change our plans and now I would like to ship it to Europe. Would it be better to import the vehicle to Spain or the UK. Thank you and stay safe everyone! Danny

great

What needs to be done for me to import my 1969 Jaguar from the USA to the UK to be used for car events? Since some of these events have now been postponed due to current issues, I don’t plan to ship the Jag back to the USA until Sept. 2021. I am a permanent resident of the USA.

Are you planning on registering the car in the UK? I’m not sure how long if at all, and what you need to do to drive the car temporarily in this country on another countries registration like the USA.

No, I only plan to drive the Jag to car events, and then ship it back to the States around Sept. 2021. When I’m not driving it to/from events, it will be sitting in a classic car storage unit.

Here’s some info on that kind of importing; https://www.gov.uk/importing-vehicles-into-the-uk/temporary-imports

quick question. is it 30 years and older or over 30 years? looking at a registered 1990 car in the US.

Hello Emma,

Buying a 1950 pick up already imported with a Nova Cert. but not reg. Does this vehicle need a roadworthy cert.

Thank you.

Hi Mike, from experience on a classic car like this, registration goes a lot smoother if you get the car an MOT. You can ask an MOT tester to do this on the vin or engine number, as the car of course does not have a UK registration yet. Hope this helps. Kulraj

Thanks, all I need to know.

Mike S.

Hi I am looking to import a 1949 mg Into uk it has had a supercharger fitted to engine? Will this mean I have to pay import duty?

Hello I am looking at buying a 1960 car which has been in this country since the 1990’s. It came from Norway but was never used on the road or registered here. What would I need to do to register it here?

I have imported a citroen traction avant 1952 for a restoration project, can you advise who provides a valuation service for the HMRC?

The Traction Owners Club offers this service – check http://www.traction-owners.co.uk and join the club for help and comprehensive spares availability

I’m importing a 1972 Corvette very soon from the US. Where can I find a list of the modifications needed to the lighting system to pass a MOT test. Would these mods be the same as those required for a much newer car?

Hi neil, just browsing and saw your query re importing a 72 vette. I am trying to go down the same route, did you manage to get one over , be interested to talk to you to see what the cost and procedure is. I am looking for a 70/71/72 with 350 motor and pref 4speed over auto. My no is 07812 571262 if you had time to talk. Many thanks, best regards, Gary Watts

my Son has imported a Porsche from Spain as a rolling shell for a complete rebuild. He has all the documentation, receipts etc. At the moment it is not road worthy and need a complete renovation and rebuild. Should he register the car now or when it is complete?

I have a very similar question to Noel Faulkner’s. The car I have is originally a UK vehicle (right-hand drive) but is currently in Italy and unregistered. It still has the UK plates it was first registered with and I have documentation (via a UK car club) from the manufacturer that it is on their list of VIN and chassis numbers for these cars (not many made). It a 1971 model and is in excellent original condition. My question is: Can I get it re-registered remotely as a UK classic car without needing an inspection from the DVLA so I can drive it back into the UK from Italy? It was exported from the UK into Italy by previous owner, but never registered there.

The important thing here is whether the DVLA still has the vehicle on its computer records, and that a current V5c reg document is available. You can check on-line at the DVLA vehicle check website. If there is no current V5c (not the old V5) then you will almost certainly need to get the vehicle inspected. Driving it home would be a tricky one, although in theory you could get it insured on the chassis number, as if it was a foreign-registered vehicle.

Hi Keith thanks for your reply. The car is still on the DVLA site recorded as unregistered (MOT expired 2007 – which I guess means exported). I have the paperwork that said he legally exported it from the UK. I have the most recent (2007) V5C. It was never registered in Italy, only ever in the UK since new. It has been stored for the past 12 years. Given that, could I get it re-registered in the UK prior to it being physically re-imported, if it’s insured and I pay the 5% VAT to customs when I come back in with it? Would love to be able to drive it back to the UK if possible.

Ah, if the vehicle is registered as having been exported, then the V5c you have is no more than a piece of paper. The vehicle will have to be re-registered once back in the UK, but that’s not something you can do while it’s abroad. Well, you COULD try it by applying for the UK reg as if the car was still here but the chances are the DVLA will want to have the vehicle inspected to prove it exists and is what you say it is (too many people have been trying to sneak cars in under the classic car ‘historic interest’ banner and the DVLA has finally got wise to it). You might just have to give the DVLA a call (they are pretty helpful on the phone) and see what they say. Once you do that, of course, there’s no turning back. Not an easy one, and I suspect you’ll need to get the car trailered home.

Thank you for a very interesting and informative article. I have a small question. If the car was UK made and UK registered initially and then exported to Australia many years ago. Is the 5% Vat still payable on bringing it back to The UK?

In theory, no, but will depend on whether you can provide adequate proof – not just showing them a vehicle wearing UK plates…

Hi Emma , I am wondering will this new tax ,

nitrogen oxide (NOx) be applied to classic cars !

My friend has a 1984 Mercedes with U.K. plates !

It will be a disaster if this tax is applied ! It’s a 2.8Petrol .

Blessings Patrick

No, classic cars are exempt from the emissions regulations.

Hi, I’m thinking of importing a 1953 VW Beetle from Holland to the UK, but it’s still on Swedish plates and is registered in Sweden – what do i have to do to get it over to the UK. I will be driving it back from Holland, but want to know the best way of going about importing. Thanks

In section 3 The process steps a):

Importing an orignal 1953 British car from Italy , If the seller trusts me do I need to get temporary plates at all ? or can I drive it home with their plates. They are happy with this.

Thanks

Hi, I have a 1958 American Ford imported a few years ago currently wearing an age appropriate plate. If I transfer that plate to another vehicle will the DVLA issue another age appropriate plate to the ‘58 Ford?? Thanks, Tony

You cannot transfer an age-related plate to another vehicle. However, you CAN transfer a personal plate to a vehicle which previously wore an age-related plate, as long as the personal plate is not newer than the age of the vehicle.

Hi

I’m hoping on bringing a 1962 Citroen 2cv back from Spain to the U.K. the car a restro project so doesn’t run at all

Any info much appreciated

Thanks

Really good article. Question. I am interested in ” importing” a 1968 European built LHD classic Vauxhall from France. It never had seat belts or anchorages from new. It has the French equivalent of an MOT at the moment. Will it pass the British MOT without the belts – any exemptions for this? Thanks in anticipation.

Regards,

John Grant.

No, all vehicles built after January 1st 1966 must be fitted with seatbelts.

If I import a 1968 car from the USA would I have to put a number plate ending with a letter denoting the year of manufacture on it (1968 would be G) or could it be personalised plate?

Is it better to ship a classic car loaded in the container or roll on roll off? I know the ro-ro is the cheapest option … I have contacted few companies and they did not say anything but https://usgshipping.com customer service told me for a classic car, better to go with a container. Price is higher but it safer. Any other company to recommend?

http://www.kingstown-shipping.co.uk – the only company I would trust. And yes, use a container. Don’t go ro-ro!

Hi Emma , I intend shipping my dad’s Ford Cortina MK3 from Malta to the U.K. The car is registered in my name and has a current Maltese VRT (MOT) and insurance. When the car arrives (probably at Tilbury port) I presume I will be able to drive it to my garage as I will get a green card insurance. Once here then I will arrange for an MOT locally and register it with DVLA. Do you recommend any insurance companies for such cars here? Many thanks, Robert Hero

Hi

I have a car that has been registered and driven in Guernsey in the Channel Isles for the last 21 years. I am hoping to import the car into the UK.

Guernsey is outside th EU and we don’t pay VAT here.

Any advice? Have you had experience of this scenario?

I will be returning to the UK next year and need to understand the costs/implications.

Thanks

David

Good Morning ,

I’m looking to buy and import an Alfa Romeo Junior from Switzerland into the U.K.

Are there any particular rules and costs Involed as Switzerland is outside the EU or for import purposes is Switzerland treated the same as in the EU ?

Kind regards

Leo

Dear Emma,

I own and drive a more-than-30 year old Golf in Switzerland which is officially registered there as a “classic vehicle” and which I would love to bring into the UK. BUT! For a car to be classified as a “classic vehicle” in Switzerland, it needs to be over 30 years old (amongst other requirements, such as “in orginal, non-modified state”). In the UK, however, I am told, it has to be 40 years old. That is all-important because one of the main reasons I want to bring it here is because of the ULEZ regulations coming. (I live in London). My question: does it make a difference that it is already registered as “classic” in its Swiss documents or not? I am very grateful for your reply-

My inkaws have lived in Spain since 2001 and drove their uk registered xr3i over there, it is now registered on Spanish plates. I’m having it brought back to the uk in the next few weeks. Can I request to have the old reg number back and also what forms for the dvla will I need.

Thank you Simon

Hi i am considering buying a barnfind 1971 vw from italy to uk, owner has lost logbook however – if i get the car to uk with purchase receipt, can i register in uk without current italian logbook? (libretto) thx

HI, I Want to buy a car in the Netherlands and drive it home. I have contacted two Classic Car Insurance companies who will not insure it till it is in the uk. What am I missing?

Hi,

Thank you for the above article. I am importing a Classic car from Sweden. My Swedish friend is bringing it over to the UK and it will be stored in my garage. It is right hand drive and has full Swedish papers, MOT etc. I’m just looking through the Registering process and it seems that the Classic car (1975) will need to be registered with the HMRC within 14 days, wait 48 hours for VAT clearance then send the V55/5 to the DVLA. However, i can’t see any mention on the DVLA links when to have the car MOT’d. I guess i need to wait for the V5 to be sent to me then i can insure and tax the car. Then MOT it? Am i on the right lines? Your assistance would be helpful.

Hi James

You will need to insure and MOT the car before you apply for the V5 as you have to send off proof of insurance and a valid MOT certificate with the V55. Also you will need the Nova form from the HMRC stating that the taxes have been paid.

It sounds awkward but it is actually very straightforward if.

Hi,

A great article, thanks. I’m hoping to import a 1970 jaguar to the UK from USA. It is a part complete project so is unlikely to receive an MOT within a year or so of being in the UK. Is this s problem or do I simply pay the D&V, take it home and wait until it is roadworthy before I MOT it and register it with the DVLA? Many thanks. Roderick

There is no time limit on how long you can have the car in the UK without registering, the only stipulation is on payment of tax. As the vehicle is being imported from outside of the EU then it would need to be customs cleared and taxes paid upon arrival. If you need assistance with shipping or customs clearance please feel free to contact me at keith.hazel@lvshipping.com

Hi

I’ve found an old Renault in France , it’s been sat for years but there’s no reg documents or any paper work with it , how can I go about bringing it to the U.K.

thank you

Mark

If I buy a classic tractor (1963) so over 50 years old, from a non eu country, do I just pay the 5% on total including shipping? Thanks PS. Excellent article by the way! Tractor was manufactured originally in Germany.

Hi Emma

I have a restored 1957 jaguar mk8 in New Zealand and would like to ship it to the UK and sell it.

Is this possible and what would be the vat and duty liability?

Regards

David

Hi David, as a general rule vehicles over 30 years old will usually be accepted as being of “historic interest” and would only be liable to VAT @ 5% with no Duty payable. Please feel free to contact me for assistance keith.hazell@lvshipping.com

Hi Emma, Great article… But I would like to know – I bought a 1985 BMW M635 CSI In the UK 10 years ago, and brought it to Australia, where I have been living. If I Imported the car back to the UK, would there be any UK VAT or duties payable?

Hi Richard,

If you look at the important notes section 6.0, there is a chance that since the M635 CSi was a rare car, it might be deemed as having historical interest and so a reduced VAT of 5%. Worth taking a look at.

I have imported loads of cars and they always put the Duty at 5% if its over 30 years old. just use a decent clearing agent and they will sort it for you

Just so you all know my experience of using Autobox Logistics Ltd Essex which is carshippingmadesimple website part of Cargo Marketing Ltd. I drove to their shipping associate warehouse in Houston end of Jan 2018. They said it would be in Southampton in a month. After chasing and chasing it turned up in Felixstowe three months later. I was not happy and persuaded them to transport by truck to me in Devon at a subsided cost. I paid half, another £250 to swallow. It was left in the rain at Felixstowe and water had got in soaking carpet and seats and trim. It had been driven hard in reverse it looks like and damaged the underneath behind the rear axle inc fuel tank and twin exhausts and the bottom of both rear wings. Its a fully restore american classic. It has been 51 days since and still not repaired and they just ignore you as a customer and give the impression they don’t care. Very very poor customer service. Very nice when booking though. I cannot recommend this set up at all.

hi I am thinking of purchasing a mga 1956 which has been imported into the UK from Australia.The owner now wants to export it back to Australia because the cost of keeping and registering it in the UK is too much. It has been advertised here in Australia at a very low price,?. Comments please.

Hi Graham

I have had a similar experience with a jaguar advertised in Australia but now in UK. Owner was unaware of 50%? Import duty and wanted to ship the car back. Also advertised here at low price.

Wonder if it is a scam?

Hi Emma

I want to Import a classic car from outside of the EU to the UK NOT Made in the EU!

Soviet Gaz 21 1964.How much I’ll pay vat and duty??

And do I need to proof somehow that this car is no longer in production??

Thanks

I have just imported a 1967 Jaguar E-Type from the USA to the UK, how do I get the vehicle history? I have the VIN number and was wondering if there was anyone who could advise me on where I will be able to obtain this information from?

great write up cheers

Contact Jaguar heritage in the UK, who for £45 will send you a heritage certificate for your car, giving the date of manufacture, the destination country and city, along with the numbers for the chassis, engine and gearbox.

If you check in the USA try Carfax who should have an online facitlity to show the history of your car in the USA.

Hi Emma

I have the chance to purchase a 1953 split screen Morris Minor in South Africa, although this car is in good condition there is no registration documents, is this going to be a problem if i was to export it for sale in the UK.

If it is a viable proposition can you recommend anyone that can help with all the paperwork in the UK and post it for sale

Hi, great article…I have a couple of questions…..I am in USA, would like to give my all original 67 camaro to my daughter, UK/USA dual citizenship…..will there be any vat if the car is free? The engine is original, if I would install a 2002 ls 5.3 engine for reliability and drivability, would that change the 50 year old status? Would it be better if I own the car til it gets to UK?, Or if the transfer takes place before we load it on the boat? Thanks!

Thanks for a helpful article. I recently imported as a first timer, a Mercedes Pagoda from California. Apparently there is an additional cost risk that isn’t mentioned in the article. US customs inspect a small percentage of cars being inspected and costs are charged to the purchaser. This can be an also mean you miss the intended ship. It’s a gamble you can’t be sure of but to be safe allow a contingency fund ~ maybe 1200 GBP. I was lucky and got through. Less importantly unlucky on delays, despite using a big recommended carrier, my car was apparently overlooked in the warehouse and missed its first intended shipping. Then the ship was diverted from Felixstowe and container had to be transferred ~ fortunately without incident or damage. Also insurance in transit. The ship is very unlikely to sink but containers get dropped in loading and damage can only urge in warehouse, so vital you check if you are buying on ship only insurance or “gate to gate”. I went for the latter ~ not necessarily more expensive but shop around. It’s a long game and you don’t want to let it be stressful, but it can mean you get the deal you really want and the car you couldn’t otherwise afford or justify. Happy motoring and don’t get into the stress! Ian Bainbridge

Hi

We have purchased a Mustang in the USA from a mother of a friend of ours. The friend is in the motor trade and has renovated the vehicle at our cost. it will not be long before it is ready for shipping.What must be taken into account when informing the customs. The vehicle has not been modified in respect of changes to ability but as you can imagine on a 1965 car things have been replaced like new wheels, the electrics have need updating, and headlights changed for our roads. it has also been re sprayed.

Hi

Im looking to buy a car bro Itlay and I want to ensure its not stolen/ damaged etc How do I check?

Hello Emma,

Are these rules the same for importing a car from Bahrain in the middle east?

Hi Ashley, yes these rules apply. You’ll see section 4 explains the rules for imports outside of the EU.

Hi Emma, I have seen a car in Texas on ebay that I would like to buy. Its a 1956 model so its 62 years old. It will be tax and MOT exempt here but of course the lights would need making legal. My question really is: will I have any import tax to pay?

Cheers, John

Hi Emma, excellent article, very well done indeed. Is this guide applicable to motorcycles as well? Cheers.

Hi Mike, we believe it does.. yes.

Hi, I’m looking at importing a VW Golf 1978, I’m trying to decipher import/VAT charges that this will be liable for. It’s 40 years old born in Germany, I’m a bit confused as to whether it qualifies because it is “at least 30 years old and of a model or type which is no longer in production” but obviously the Golf is still being made today. Any help would be appreciated!

The rules above apply. So section 2 if importing from Europe or 3 rest of the world. All the best.

We have a Sierra xr4i 28 years old, we brought it in tenerife where we have lived for 24years, it’s motd and is tax exempt, but all papers are in our name, it came from tenerife in a container with our other belongings, not sure what to do next, could you please help me

Hi Sharon, take a look at the guide on registering your car here: https://www.tradeclassics.com/how-do-i-register-an-imported-classic-car-in-the-uk/

hi

I want to import a classic car from outside the EU and resale it after

how can i do this,what is the procedure?

I have imported a 1930 Caddilac from USA, I am vat registered, I paid zero duty but 5% vat. If & when I sell is this vehicle plus 20% vat ? Thanks

Excellent article thank you. I note in your introduction that you make an assumption “you are a private individual car owner who wants to import a classic car for non-business reasons and not for re-sale” . Can you advise what restrictions are placed on a sale following importation?

Can you advise me on insurance for my classic car during my driving it to the uk from italy. I calculate that the trip will take 1 week

Good check list. For cars from the US to the UK, Import Car also lists the various steps, including registering and has a lot of useful links to specialists at each stage.

hi Emma

Just read the article, BRILL and I’m taking from a Logistics / Customs Clearance point of view. The number of calls when importing cars from clients “why am I paying Duty / VAT” . Why Do I have to fill all these forms in. Great Article.

Thanks for your feedback Sian… appreciate it 🙂

Hi,Ive just bought on a merc 190D 1992 in germany,it has a TUV till 2018 and is in very good working order only covered 45000 km .The dealer will deliver to me, however how could I get a uk reg for the car so I can drive back to the uk and insure?

Thanks.

Hi Tony… you’ll have to follow the steps in this article. You can only get a UK number after you’ve imported it and got it MOT’d.

Hi Ive just bought a non running and needing work Ford 300e from Portugal ive bought it modify. Do I need to get an MOT to register it ? As it is it would need more work to MOT as standard. Thanks

Yes I believe you do… the steps are to get an MOT then you can apply for a V5 cheers

Thank you so much for your article Emma, fantastic and incredibly thorough.

I have recently bought a 1967 Lancia Fulvia from Bologna,Italy and had it transported back to the uk through a private transporter firm.

The car failed its MOT in the UK but I am presently having the works carried out.

I have not as yet informed the DVLA as I’m waiting for the car to be up and running.

Should I have done this already?

Also will I be liable for the import duty, this was not clear to me as the cars over 50 years of age?

Thank you, Gulliver

Hi Gulliver,

You have two people to notify;

1. HRMC within 14 days of the vehicle arriving into the UK. Here’s a link https://www.gov.uk/importing-vehicles-into-the-uk/telling-hmrc

2. DVLA only after you have got the car through an MOT to apply for a V5 registration document.

Regarding the Duty question; the car was made in the EU and is over 30 years old so you should just have the £50 Admin fee to pay. HMRC will confirm this position with you when you contact them.

Cheers

Adam

Thanks for this article Emma. We are currently driving our South African registered, 1988 Toyota Land Cruiser up through Africa with the intention of importing it into the U.K. when we’re done. As a result your article is very useful.

One question, you mention the positive VAT implications for cars over 30 yrs old. Is that from year of manufacture or year of registration?

Thanks a bunch

Guy

Hi Guy,

No problem – glad we could help.

We’ve just phone HMRC to check and it’s the manufacture date.

However their statement in VAT Notice 702 Section 11.4 “at least 30 years old and of a model or type which is no longer in production” does not specify this, but as they have verbally confirmed the manufacture date then you should go with that.

Of course the title documentation may not have that date on as that paperwork usually has just the registration date. So if you need that date to save 15% in duty then you’ll need to work with HRMC to prove it, i.e. you may need to supply additional documentation, e.g. a certificate of authenticity / build certificate etc from the manufacturer.

Here’s the link again to the HMRC notice 702 https://www.gov.uk/government/publications/vat-notice-702-imports/vat-notice-702-imports

Hope that helps.

Adam